How Hiring a Nanny Can Cost Less Than Daycare

Having you been debating whether to hire a nanny? Many people think that they cannot afford this personalized childcare service, when it may be cheaper than what they are currently paying for daycare. Below we explain the costs involved and provide a few handy charts that you can compare to what you are currently paying.

Hiring a Nanny Can Cost Less Than Daycare

Do you have two or more children? Smart parents that do the math will soon realize that for many families with multiple children it costs less to have a live-in nanny than it does to drop the kiddos off five days a week at daycare.

Average monthly fees, full-day daycare centres by age group in 2012

| Province | Cost ($) | ||

| Infants | Todders | ||

| NL | n/a | 773 | |

| PEI | 696 | 566 | |

| NS | 825 | 694 | |

| NB | 740 | 653 | |

| QC | 152 | 152 | |

| ON | 1,152 | 925 | |

| MB | 631 | 431 | |

| SK | 650 | 561 | |

| AB | 900 | 825 | |

| BC | 1,047 | 907 |

Source: Early Childhood Education and Care in Canada 2012, Published in The Globe and Mail, October 23, 2013

For example, a caregiver in Ontario working 40 hours a week making the minimum wage for a live-in caregiver (currently $10.86 but rising to $11 in June 2014) would cost a family about $400 per week out of pocket (assuming they are charging the full room and board amount and there are no taxable benefits). A family with two children or more in daycare in the same province typically pays more than $400 a week for childcare.

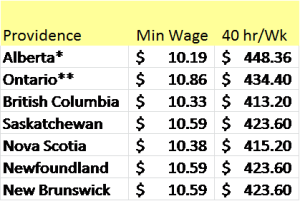

See the chart below to see what the minimum salary is for live-in caregivers in your area.

*Alberta requires a minimum of 44 paid hours for live-in caregivers. **Ontario minimum wage is changing to $11/hr in June 2014.

The Room and Board Deduction

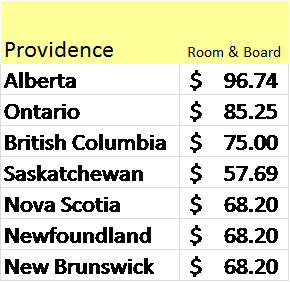

In Ontario, a family may subtract $85.25 per week for the caregiver’s room and board, which also helps bring down the out of pocket costs of live-in care, as seen above. This amount includes meals, varies by territory or province, and is the maximum that one may charge. See the chart below for an example of the current room and board rates as of March 2014.

When hiring a nanny, make sure this deduction is clearly written out in your nanny contract. You do not want to spring this surprise on your caregiver on payday without talking to him or her first.

Additional Tax Benefits and Deductions

When tax time rolls around, there may be additional benefits and deductions to having live-in help. Did you give your nanny a birthday gift or religious holiday gift? Remember that cash, near-cash gifts, and gift certificates are always taxable for the employee. On the bright side, you can deduct up to $7000 per child from the lower income earner of you and your spouse which can result in a return on your taxes. Speak with your tax expert or visit the CRA website for more information.

Note that employers are responsible for calculating amounts and holding deductions for EI, CPP, and other area taxes. Not good with math? No problem! This is why so many Canadian families turn to NannyTax; Canada’s first and longest serving nationwide business dedicated to nanny payroll tax solutions. Visit us today for headache free payroll services and let us know what we can do for you!

How does having a caregiver save your family money? If you liked this article, have any tips, or found it useful please leave a comment and let us know! We LOVE comments!